njtaxation.org property tax relief homestead benefit

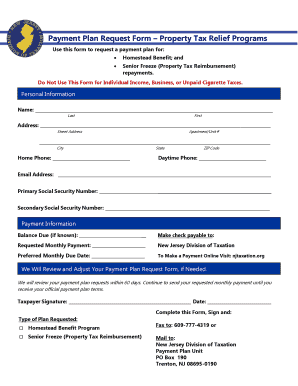

If you are delinquent in paying your property taxes you are still eligible to file an. Property Tax Relief Forms.

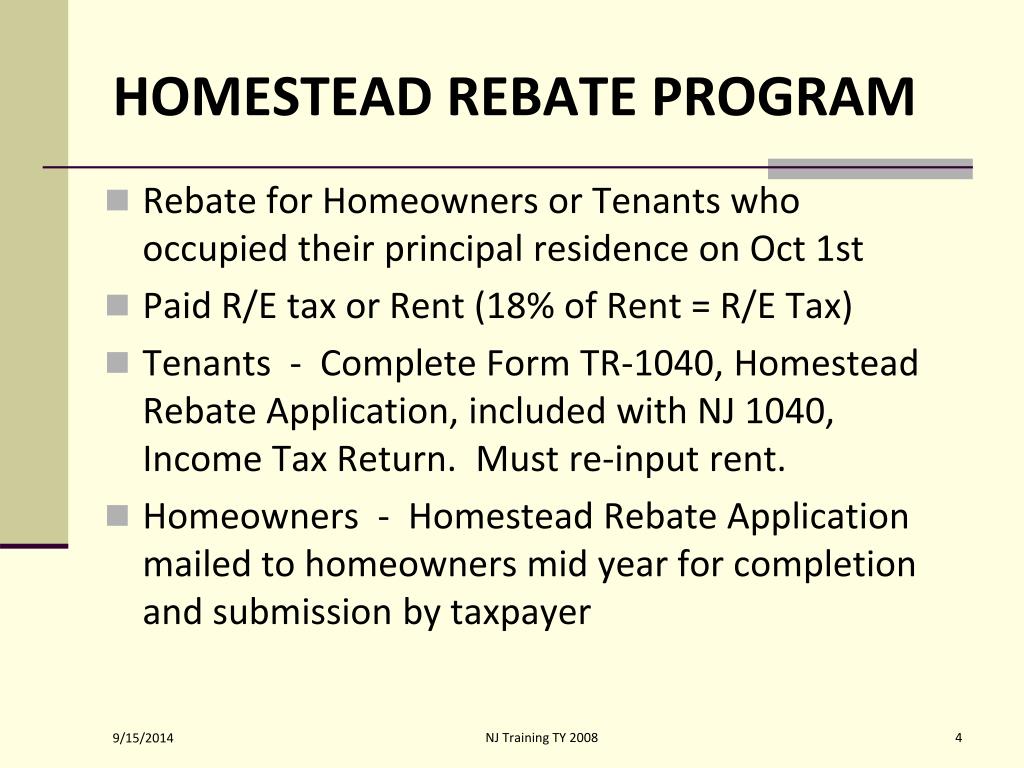

Prior Year Homestead Benefit Calculations.

. You can get information on the status amount of your Homestead Benefit either online or by phone. Online Inquiry For Benefit Years. Most recipients get a credit on their tax bills.

Can I still file for a Homestead Benefit. Applications for the homeowner benefit are not available on this site for printing. Your benefit payment according to the Budget appropriation is calculated by.

Property Tax Relief Programs. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 -. Other Property Tax Benefits Administered by the local municipality Last Updated.

If a benefit has been issued the system will tell you the amount of the benefit and the date it was. 2016 2017 2018 Phone Inquiry. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018.

75000 for homeowners under 65 and not blind or disabled. 1-877-658-2972 2018 benefit only Last Updated. Search here for information on the status of your homeowner benefit.

If you filed a 2018 Homestead Benefit application and you are eligible for the same property see ID and PIN. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. My 2018 property taxes are late.

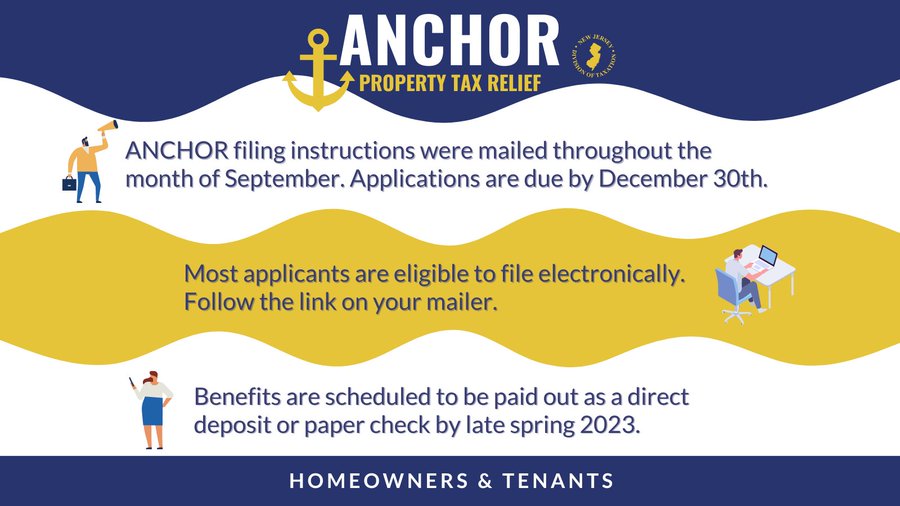

See ANCHOR Program for more information or you can call 1-888-238-1233. 2018 Homestead Benefit payments should be paid to eligible taxpayers. If your New Jersey Gross Income is.

Property Tax Reimbursement Senior Freeze Program.

Tax Collector Woodland Park Nj

Fillable Online Payment Plan Request Form For Property Tax Relief Programs Fax Email Print Pdffiller

Frankford Township News And Announcements

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Tweets With Replies By Nj Div Of Taxation Nj Taxation Twitter

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

Nj Anchor Property Tax Relief Program Replaces Homestead Benefit Middlesex Borough

Nj Division Of Taxation Contact Us

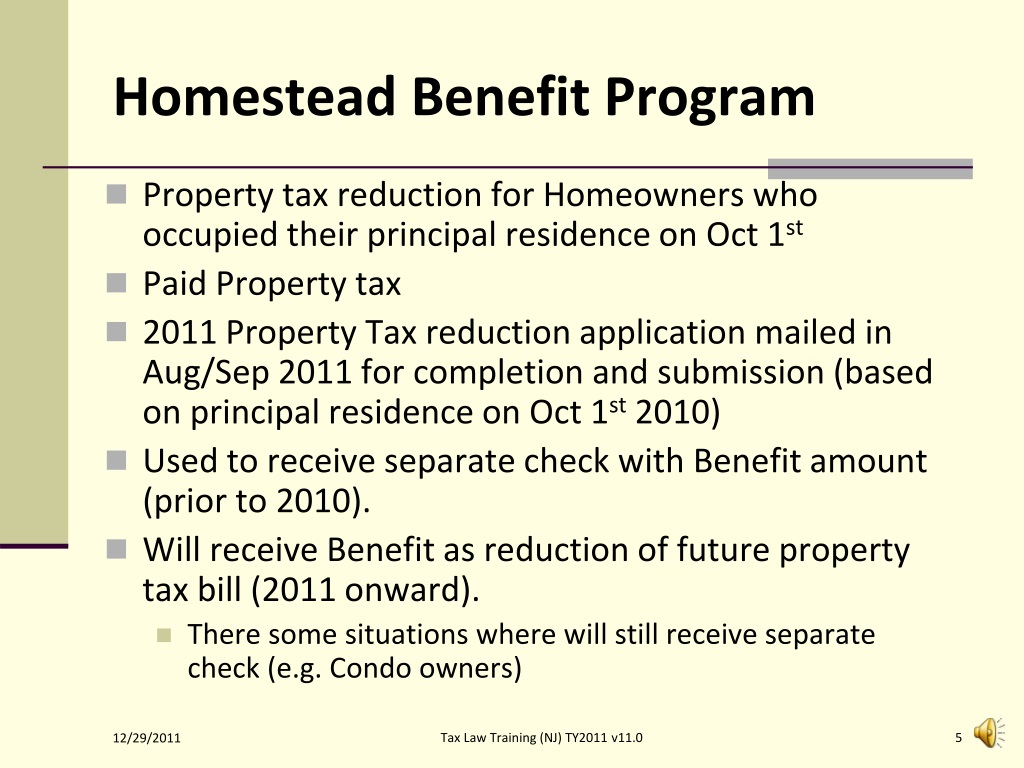

2011 New Jersey Volunteer Tax Preparation Nj Division Of Taxation Linda Hickey Jim Gordon Www Njtaxation Org Ppt Download

Nj Division Of Taxation Trenton Us

Apply For Nj Anchor Tax Relief This Fall Montgomery Township New Jersey

Nj Division Of Taxation Audit Activity

News Flash Clark Township Nj Civicengage

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 1525957

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement